What is automatic enrolment?

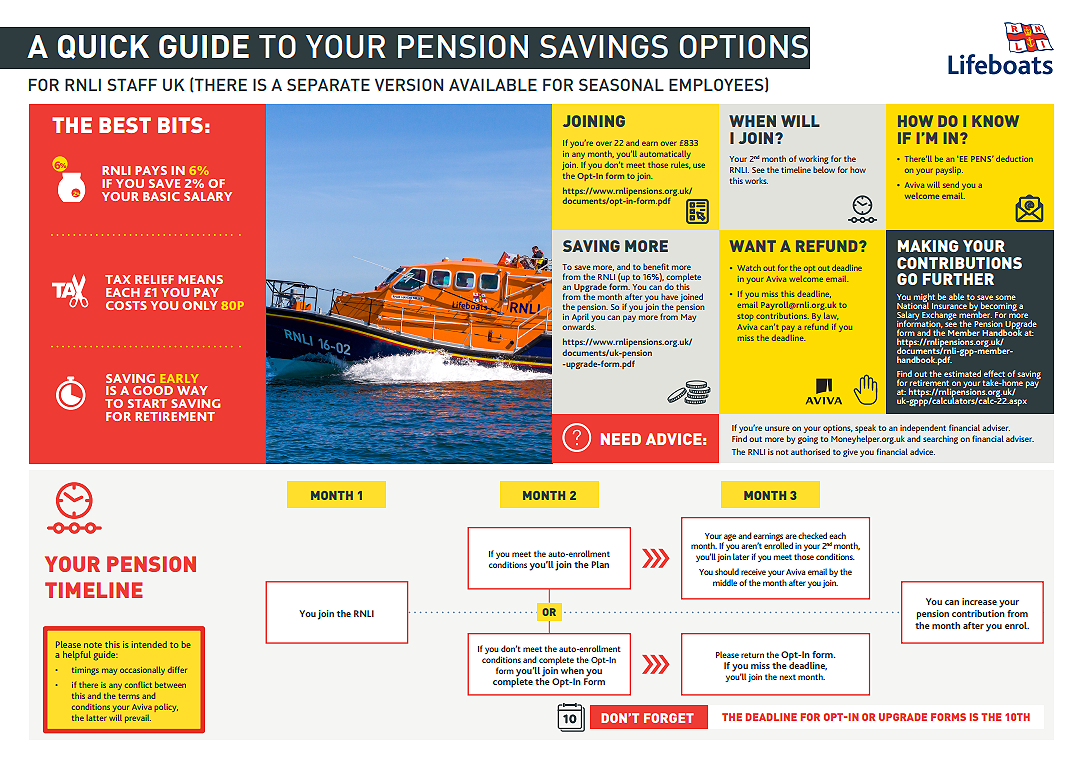

The UK Government has introduced a law designed to help people save more for their future.

This law requires all UK employers to automatically enrol their workers into a workplace pension scheme. It applies to all workers that meet certain age and earnings criteria, and even if you don't meet the criteria to be automatically enrolled, you may still have the right to join the RNLI Group Personal Pension Plan ('the Pension Plan').

Opt In form:

If you are under the age and/or earnings thresholds to be automatically enrolled but you want to join the Pension Plan, please complete the Opt In form and send it to Pensions@rnli.org.uk for processing. When you join, you will contribute 2% of your salary and the RNLI will contribute 6%.

Opt-in form – pdf

Upgrade form:

If you currently contribute the minimum 2% to your pension, if you want to increase how much you add to your pension, complete the Upgrade form:

Upgrade form for UK pension joiners – pdf

Member Handbook:

Find out more about automatic enrolment, salary exchange, which funds your pension is invested in, the charges that apply to your pension investments, the options you have to turn your Pension Plan into an income as well as the additional employee benefit of life cover in the Member Handbook.

Member Handbook – pdf

Expression of Wish form:

Tell us who you wish to be your beneficiaries of your RNLI pension and life cover arrangements by completing an Expression of Wish form.

Expression of Wish Form – pdf